Cash Flow-Based vs. Goals-Whatever Financial Planning Software |

| Site Information (is listed below. The financial planning software modules for sale are on the right-side column) Confused? It Makes More Sense if You Start at the Home Page How to Buy Investment Software Financial Planning Software Support Financial Planner Software Updates Site Information, Ordering Security, Privacy, FAQs Questions about Personal Finance Software? Call (707) 996-9664 or Send E-mail to support@toolsformoney.com Free Downloads and Money Tools Free Sample Comprehensive Financial Plans Free Money Software Downloads, Tutorials, Primers, Freebies, Investing Tips, and Other Resources List of Free Financial Planning Software Demos Selected Links to Other Relevant Money Websites

|

What is "Goal- or Goals-Whatever" Financial Software?

This page is not the best place to start, so it helps to read the financial planning software tutorial primer page here first. Goals-orientated financial software (goalware) is just as easy to understand as actual real cash flow-based financial planning software is hard to understand. This page is only about understanding what goalware is about. It does this by comparing the differences between goalware, and actual cash flow-based financial planning software (and modular planning). Goalware is only for performing analysis, planning, and future forecasting of financial goals; which is just one of the many parts of financial planning. So it's not actually financial planning software, it's just a part of it - just like all of the other modules listed on the right-hand column are parts of the whole (which from us, "the whole" is the IFP product). What goalware has morphed into in this century, however, is the most popular sales and marketing tools used to maximize sales of commission-based products to investors. Goalware is in the middle of the industry's great tug-of-war between the commission-based Broker Dealer and fee-only RIA business models. Since this is "Wall Street," this means there's much abuse, shenanigans, debate, and controversy surrounding goalware. So if you like studying humanity's epic battles between "good and evil," "White Hat vs. Black Hat," how the "99% is controlled by the 1%," "Main Street vs. Wall Street," etc. and so forth; then look no further - because this subject is ground zero in one of the biggest ongoing social struggles of all time! This page, and links to other pages, will answer most questions and will resolve most issues with this sore subject. Most vendors branded their goalware with every combination of the words "goal," and "goals." Just about the only thing left was Goals Only, so that's what ours is called. This best describes what it really is. A point is whatever word the vendor puts after "goals," doesn't matter, because all goals software works the same way. They all have a different set of bells and whistles that appeal to a different customer base, but the main core calculation engines function the same way with each vendor. Also, we coined the phrase "goalware," to replace "goals-oriented financial software" to keep things simple. At least it's a better word than "Goalware," which is what it usually is. So that's between five to ten new words we've made up, that are commonly-used everywhere today (still waiting for the paycheck from that too, haha!)

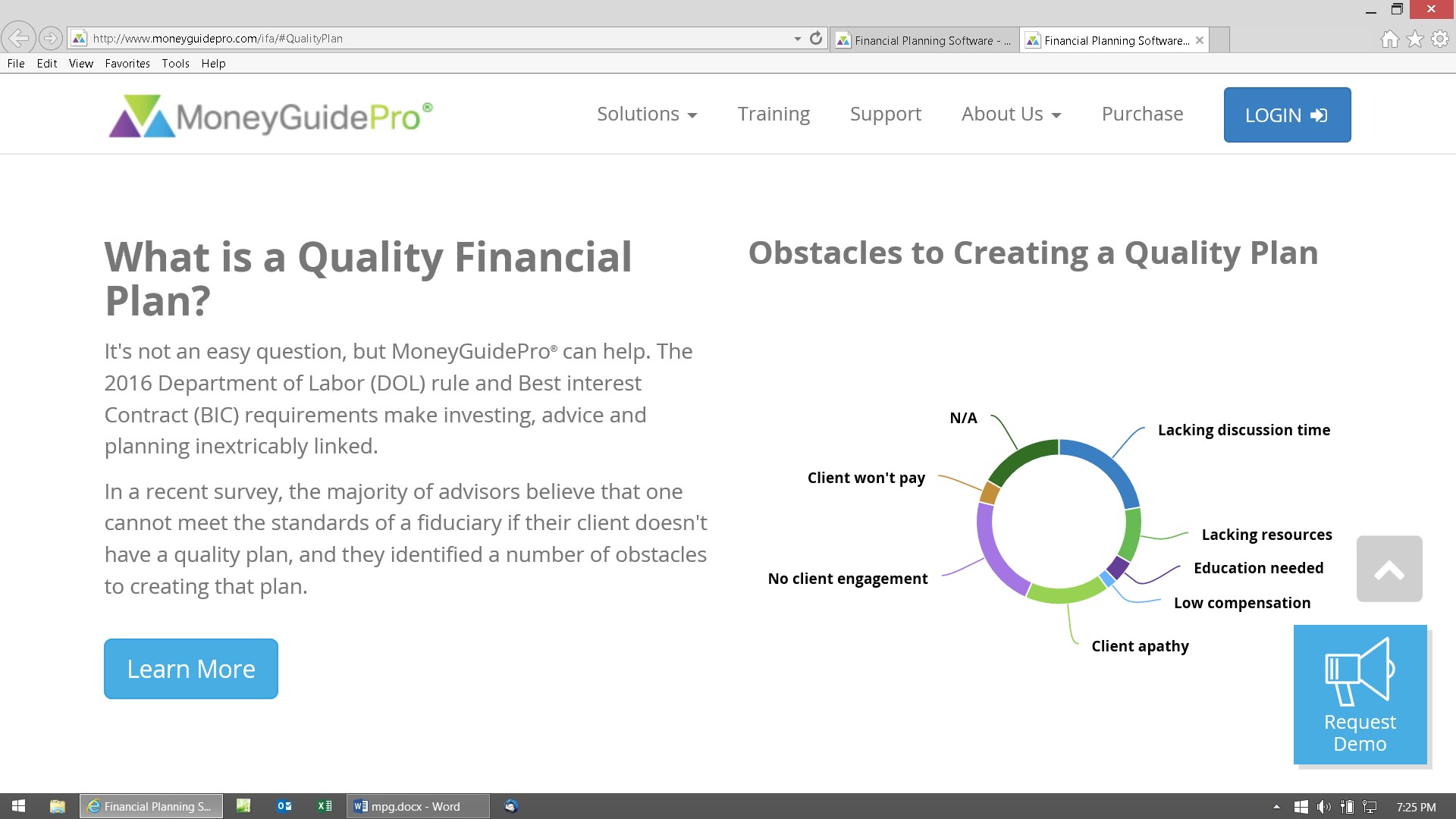

The short version is that in actual real cash flow-based comprehensive financial planning software, all of the modules are as linked together as much as possible. So when a change is made in one module, those changes flow throughout all of the other modules in all years. In goalware, they are not. Changes made in one module do not affect any other modules, nor does it affect any other year's data at all. This is how ours works - all twenty goal calculators are totally independent of each other. This is one reason why goalware is "fake" - that and there usually aren't any other modules. For example, in the Real World, if one has to spend $25,000 replacing a roof in year three, this affects cash flow and net worth; which effects the annual cash flow surplus or deficit in that year, which may effect contributions to investments for more than one year, which may make a retirement plan win or fail. Cash flow-based planware accounts for all of this, and goalware just ignores it all. This huge expense is not even input into goalware at all (because usually only first year expenses are input, and then a generic inflation rate is assigned to grow it into future years). In this example, goalware goes along thinking that $10,000 is used to fund college or retirement investing in years three and four, when this money had to be diverted to fixing the roof. This is just one of its many failures that make its numbers seem like they're from BizarroWorld. One of the advantages of goalware from the point of view of the salesperson making commission from the $10,000 annual retirement fund contribution, is that they want this commission, regardless if the investor can afford it or not. So goalware projects rosy scenarios, when they're not possible in the Real World. This makes the duped investor feel good about their fake financial plan, and their fake financial planner - but only in the short run. Long-term, one cannot escape financial reality, so eventually this chicken will come home to roost. Then when the investor complains, they usually find the Rep "no longer works there." So now they're an "orphan," pawned off on the greenest rookie fake financial planner at that BD's branch office. So the cycle starts over anew - ripe for a fresh round of commissions. This is just one of an endless list of examples of how goalware harms investors and ruins lives to the point that Finra should ban its use altogether. Actual cash flow-based financial planning software can be summarized by accounting for everything together in every year. In order to account for everything, all of the different parts of the whole need to be hard-wire linked to each other in all years. The heart of a financial plan is the budget and cash flow. This is what pumps life throughout the whole body. Goalware only performs a rough estimate to calculate the first year's deficit or surplus - if it even has a budget tool module at all. BD Reps will say to put the budget surplus into a variable annuity every year, even if it's obvious that years after the first will be in deficit. The point to keep in mind is that after the first year, every number in goalware is fake. A main reason for that is in order for the second year's net worth to be accurate, the first year's surplus or deficit has to be factored in. This is done by linking everything together. There are none of these links at all whatsoever in goalware, so that's why it's fake. Actual real cash flow-based financial plan software has all of these required linkages in every year. The primary link here is the annual cash flow surplus or deficit. These are accounted for annually, and dealt with just like a real person would in the Real World. This links up with net worth, and thus allows forecasting a one's financial life as accurately as possible. So increasing year #1's income by $1,000 makes net worth at the end of year #2 be around $1,000 more. These thousands of links form an interlocking web of numbers that all change when one number is changed. This is extremely hard to code, basically not possible using a cloud server. The main attribute of goalware is that there are no linkages of any kind whatsoever between years. It just totally ignores all reality, and only tells you (or focuses on) how much one needs to invest to reach a financial goal. Therefore, EVERY number past year #1 is totally 100% faked. Yep, that's all there is to it. Creating a real financial plan requires actual work performed by an actual professional to make it happen, and goalware requires little-to-no effort at all. So real financial software is "hard to use," and goalware is "easy to use." Goalware, like MoneyGuidePro, is not financial planning software. It is a sales tool for Broker Dealer Reps lying, cheating, and cutting every corner possible in order to get out of doing the actual hard work clients erroneously think they're performing, as they pretend to be financial planners; desperately trying to meet their BD's sales quotas by peddling commission-based American Funds and scaring investors into buying life insurance company products (e.g., annuities). This means it has near zero value for do-it-yourself investors (because lying to and cheating yourself with bogus numbers past the first year only has negative value). Fee-only advisers: Your clients are paying you fees so that you'll give them financial plans with valid numbers. You're not using sales tools to dupe investors into generating commissions to meet your Broker Dealer's sales quotas. Therefore, since goalware is incapable of producing valid numbers, either in pre-retirement goalware mode, or in post-retirement mode, it makes zero sense to buy and use it. Goals-oriented planners also have little-to-no value to investors after their long term goals, e.g., retirement, have been met. After retirement, goalware like MGP stops being in goal-focused fantasyland mode, goes into a mode similar to the way our RWR's work. So other than their numbers being inaccurate everywhere, most all goalware isn't blatantly fake after retirement begins. MoneyGuidePro doesn't even attempt to hide their fakeness either. They even see it as they main selling point in their first training video. They even seem to brag about not having to input client budget and cash flow data. That's why goalware is so popular with commission-based financial salespeople. They want maximum commissions while doing the bare minimum amount of work. Since the advent of the new century, everybody's brain has shrunk to the point that nobody can calculate, project, handle, present, nor even understand "the truth." So everyone, including the client, just capitulated to bagging all of this tedious mind-numbing work, and just decided to just say, "Screw it, I'm just going to fake it for maximum short-term profit, even if it makes the big picture fail long-term." Here's an example to nutshell goalware: Say you have nothing now, you expect to average 6% annual rate of return after taxes, and your goal is to have one million dollars in twenty years. Get out your handheld financial calculator, use an online financial calculator, Excel, whatever - it's all the same math. Input four of the five time value of money parameters: Depending on how accurate your time value of money calculator is, the answer (using the most accurate financial calculator ever created - the HP12C), annual payment, will be around $24,393. This answer is the only "beef" of value using goalware. EVERYTHING else is just marketing fluff designed to make you feel like you're watching a high-tech Broadway show in the future. The better you can dress up needing to save $25,393 a year for twenty years to "wow" people, the more BD Reps will buy and use it, to hard sell their sheeple into buying mostly loaded mutual funds and life insurance company products. That is it. Really, there's nothing more to it than putting lipstick on a pig to WOW people into giving other people their money. Can the prospect afford $24,393 a year? Probably not. There's little-to-no actual cash flow analysis going on that determines that. Only actual real financial planning software can perform this function. Only one thing matters, and that's WOWing the prospect into buying today. Is $1M enough, or too much? Dunno. Again, and as usual, the only way to tell is to use real planning software that accounts for hundreds of interlocking variables that change annually. Fake goalware accounts for, well... NOTHING! That's what the fuss is about. For an example of how goalware ruins lives, I've known couples decide to not reproduce, because it told them they needed to invest ten times too much. Investing too much can ruin your life just as much as investing too little. Their inflated "needs" make people work themselves to death to make those $2,033 a month automatic bank drafts come out of their checking account. That adds layers of unnecessary stress on families - all so The Great Wall Street Cabal can maximize income. Then it needs to be pointed out that goalware only has its limited value before retirement. This is because its only value is telling you how much needs to be invested to reach a future goal. That's why the word goal is in every name from every vendor. So after someone is retired, and have met all of their major life goals, goalware has little-to-no value. There is not one thing of value a fake portfolio optimizer married to a fake Monte Carlo simulator can do to maximize the chances of constructing an investment portfolio to both help it to maximize income needed to pay ever-increasing bills, and make it last until age 100. That's not what it's programmed to do, so it just cannot do that. After retirement, goalware stops goal-focused BizarroWorld; mode, and goes into a mode similar to the way our RWR's work. So other than their numbers being inaccurate everywhere, most all goalware isn't blatantly fake after retirement begins. The point here is that when retirement begins, then our simple Real World Retirement planners provide much more value, for only $100 to $250. In addition to the most accurate numbers in the industry, there's a very long list of reasons, features, and functionality that makes MGP's after-retirement programming look like a total joke, compared to our RWRs. So after retirement begins, then just get Dual RWR to get the best there is in this mode. Then if you're "investing" in too much life insurance, thousands a year are wasted in premiums, fees, expenses, charges, commissions, fees on the charges and charges on the fees - all on top of lousy investment performance. The same is true with a variable annuity, plus the chance of losing tons of money when markets go down due to lack of asset classes and sub-par subaccounts. Then whatever you spend on a fixed annuity is like giving a third of your money to the life company and realizing little-to-nothing in return. So all goalware can do is cause harm to the investor. There's only one benefit to the investor, and that's doing better than keeping all of their money in bank CDs. Other than that, I have yet to see anyone do great by buying life insurance company products because goalware recommended it. So another summary of fake "financial plans" generated by goalware is that most everything in an investor's life is ignored. Every dirty deceptive trick in the book is used to only focus on one thing, and that's getting the prospect to fund a variable annuity with $24,393 a year. That's why it's easy to use - because you could have ended up with the same end result (needing to save $25,393 a year for twenty years) in a few seconds using an HP-12C. Using an HP-12C doesn't make the prospect go, "Wow, look at all of those flashing bells, whistles, and moving colorful speedometer dials! That's so cool, you're a genius, I'm so impressed with your tech skills, that I have no choice but to give you my money. Where do I sign and how much do I make the check out for right now?!" MoneyGuidePro, and all of the fake software vendors, have spent dozens of millions of dollars over the last decade making their goalware have the biggest WOW effect as possible. They found a better mousetrap that sells, so no expense was spared in giving these financial cavemen the best club money can buy. The goal is to find any warm body (an 80's Waddell & Reed reference, which had to be changed to "buying unit" to be more politically correct in the 90's), and then use the club to beat their prey into submitting - by signing those life insurance company product contracts. If you build a tool that will allow dumb people to make quick big money by duping other dumb people, then they will come - by the herds. So that's what happened. The software vendors investors don't care about anything but realizing big returns on their investments, so they plow millions a year into propagating goalware. Then The Cabal was formed to cast the business model into Wall Street stone, so no power on the planet can change it. That's just American capitalism running wild at its best. That's all there is to goalware, other than: � Making goalware add up, organize, and display multiple goals at a time (and maybe even sorting and prioritizing them to maximize sales). • Using fake Monte Carlo simulators to pretend to stress-test needing to save $25,393 a year for twenty years. • Using mostly-fake portfolio optimizers to pretend to make the recommended mix of annuities, whole life insurance, and American Funds look like it's an "optimal and efficient investment portfolio." "The colors turned to green, you're going to win if you sign here give me your money today!" • Making it communicate with other types of software (AKA integration). That's it? Yes, that's all there is to it. It's all about snake oil marketing, so BD Reps can move those products and make those short-term commissions with minimal education, skills, knowledge, wisdom, thinking, attention span, work, time, and effort. Note that saving money wasn't listed. That's because goalware is in demand, so they can charge whatever they want. That's why most cost over $1,000 a year - with price increases of $100 a year (with 100% annual renewal rates). Unless your Broker Dealer is a part of The Cabal - then, of course, their Reps get half off when being forced to buy it. Everyone in The Cabal must benefit, or it will be in danger of imploding. There would be more here, but there is no more. That's all there is to it. Goalware is all about taking a simple number you could generate yourself in less than a minute, and pulling the wool over everyone's eyes with slick marketing to make it seem like there's more to it. There is not. Just get over it and move on. That's why it's fake, easy to use, and is so popular with financial salespeople that are unable perform the above simple TVM calculation on an HP-12C. There's only two public cash flow-based financial planning software programs that anyone can buy with numbers past the first year with any accuracy at all. That's our IFP and NaviPlan. There's more, but most are proprietary, or cost over $10,000 a year. The IFP is for smart, white-hat, "logical numbers-people" that want and need maximum power, functionality, accuracy, the flexibility to forecast their clients' financial futures (or your own), the ability to never lose inputted client data, and total control over printing and most numbers in every year. It's also not cloud-based, so your life is not sitting on someone's insecure server exposed to the world's evil doers. NaviPlan is for financial advisers that think forecasting taxes in detail far into the future has enough value (or are hoping estate planning will magically come back) to make it worth spending over $2,200 a year - while having to deal with a program so complex, inflexible, and sometimes inaccurate; that you'll probably have to spend thousands more on a two-week trip to take a formal training class. Then there's the very limited amount of reports you can print (that just use the same recycled chart and graph templates). Then all of the "MoneyWhatevers" (e.g., MoneyGuidePro) are totally fake, and are just a quick and easy way to put flashy and bogus numbers in front of naive investors, in hopes of making the quick and dirty annuity, whole life insurance, and/or loaded mutual fund sale. Then they're also very expensive - between $1,000 and $2,000 a year. That's a few times more than the IFP, and you can buy everything on this site for that much. Goalware is basically for dumb, lazy, incompetent, too busy to do their jobs, non-computer literate and non-financial literate, advisers that always want to cut corners to take the easy way out of doing the hardest parts of their jobs. Clients are trusting them with their financial lives, are assuming their financial plans are accurate, and sometimes paying them big bucks for creating financial plans. This is the hardest parts of an advisers' job. So that's why they fail at it. It's just too hard, takes too much time, and they don't even understand it - let alone know how to explain it to others. That's like having the first stage of cancer, and then going to a doctor that doesn't even perform a rudimentary diagnosis, and just says, "I don't know what you have, because I'm too stupid to know how to use the tools to actually perform that part of my job, so you're fine as long as you pay my bill, now take two aspirins and don't call me in the morning." So the patient is just sent home to die. The only one that met their financial goals was the adviser, because they got paid without having to do any real work. There's nothing that can be done about this, because these "scams" are how Wall Street fleeces the sheeple, so the government gets paid off to stay out of it and think it's all fine (when it should be banned). So I just say it's a "species-level failure" that cannot be fixed. This is because firm's like MGP know that the best way to get rich is to dumb everything down so the least common denominator is able to use it. Dumb people outnumber smart people a thousand to one, so thereyago - that's basic marketing to Americans 101 in the 21st century! It matters not if you're "doing the right thing," all that matters are sales. This is what I call the, "Black Hat business model." A slogan use in politics I like is, "Nobody ever went broke by underestimating the intelligence of the American people." Another bottom line is that a true financial adviser always has their HP-12C with them (the one and only true financial calculator). Try to find an MGP user with an HP-12C or that knows how to work Excel on a Windows PC. You won't. These unskilled hacks are an entirely different breed of "financial adviser" that popped up about 2005. No financial brains, just a smiley mouth spewing hyperbole as they wow you with flashy graphics. Occam's Razor all applies here: The simplest explanation is usually the correct one. After thinking about all of this for almost three decades, these are the bottom lines when it comes to adviser's choice of financial plan software. Wall Street firms just really need those dozens of thousands of dummy advisers out there moving their products, so the tools to maximize that were created. In 1980 it was fixed annuities, because of the double-digit yields. In 1985 it was limited partnerships to save taxes. In 1990 it was pink sheet stockbrokers cold calling from the phone book. In 1995 everyone was earning tons of money, so tax qualified plans were all the rage. In 2000 it was day trading technology that allowed the sheeple to lose their life savings in a day. In 2005 it was ETFs and fixed annuities again because of flat and down markets. In 2010, it was the MoneyWhatevers creating goalware. In 2015 it's the same, but greatly updated, goalware running on phablets in restaurants. It's just the tools that the masses of rookie Reps currently use that results in the best shot at short-term BD survival (but long-term failure as a financial adviser). So whatever the current fad is, Wall Street has a new and improved tool for their salespeople to peddle their products to the sheeple with minimal resources expended. There's no way around these huge problems. If you want real financial numbers, then you'll have to use real financial software - which is "hard to use." Everything to do with money is "hard." If it's not hard, then you're just not doing it right! That's why real financial advisors make the big bucks - because they actually earn it. It takes decades of education, skill honing, trial and error, becoming an expert at Windows / Excel / HP-12Cs / and other financial tools, and then knowing how to manage money and create valid financial plans - in order to consistently earn these big bucks from people that have them. Why do all of that when you can just hook up to a BD and use MGP!? Yup, just bypass the whole decades-long learning curves, pretend you know what you're doing, and fake it! Dummy advisers get into the business because they're selfish and greedy and really want these big bucks. That's why all of these "robo-advsier" sites are the current thing (that will fail). They just do not want to do the actual hard work needed to earn them. That's why they (MGP users) usually last a year or two in the biz, and then quit and go back to their old day jobs. It just takes them that long to realize that there really is no free lunch (contrary to the belief of their BD that got them into this mess, and then made them buy MGP). If you use MGP thinking their numbers are real, then you're just "peeing in the wind," because that's just not possible. That metaphor was used because in the financial business, most all "mistakes" will eventually come back to haunt you in one way or another. Occam's Razor again: That's why your "MGP financial adviser" gave up and went back to their old day job. It was only a matter of time before their clients realized they were a fraud and fired them. Like the comedian says, "You can't fix stupid!" So that's the short version of why things are the way they are. The very long versions are in the financial planning software reviews and the free Money eBook. So the IFP's target markets are DIY investors and fee-only RIAs that are in the business of trying to accurately forecast what will happen in the future financially with their clients. This is what financial planning is supposed to be about, and not moving life insurance company products for the biggest short-term commissions. DIY investors should never use fake financial plan software for their own financial planning. If you're going to do something important, then you should get the right tools for the job, and then do it right the first time - even if it's "hard." If you don't, then you should know that money does not magically grow back after you make such colossal blunders. Here's one example of such a blunder - in 2012 I found an egregious bug in NaviPlan that made it look like one could retire one to two years earlier than they actually could. They scrambled and fixed it in a few months. But everyone that took that advice, eventually found out that they did not actually have enough money to last until their life expectancy. How many lives were ruined (and how many deaths were caused) because of just that? And that was NaviPlan - a big firm that really cares about having accurate numbers. None of the MoneyWhatevers even care, and their documentation even says that their numbers are fake past the first year. In case you didn't know, after your money is gone, it's just gone forever. So if you fail, then you'll have nobody to blame but yourself - as you're eating Alpo instead of steak in your golden years. As BD Reps become less willing to do real work over time, goalware has become more sophisticated, dumbed-down, insidious, deceptive, fake, cool, fancy, flashy, modern and techie-looking, and integrated to meet that ever-increasing demand by Black Hat Dark-side advisers that are the epitome of modern-day snake oil peddlers. When they feel good about their snake oil salesmen, they don't whine to the law, so nothing happens to stop it. Then even if there was mass outcry, the government would ignore it, because they've been forced to be a part of this Wall Street Cabal since the beginning of time. "Think, analyze, spend time, do actual work, pay attention with an ever-decreasing attention span? HA! It's easier to just trust my "financial planner." After all, he's regulated by the mighty Unites States government, right? What could possibly go wrong with that? So I'll sign and give them my money today so I can forget all about it and get back to pacifying my needs with sugar, fructose, caffeine, tobacco, alcohol, and both legal prescription and illegal drugs." When they feel good about their snake oil salesmen, they don't whine to the law, so nothing happens to stop it. Then even if there was mass outcry, the government would ignore it, because they've been forced to be a part of this Wall Street Cabal since the beginning of time. The short version here is that the regulators, Finra, and the people that brought you goalware, American Funds, and uber-expensive life insurance company products are ALL THE SAME PEOPLE (that job hop between the Cabal's five players)! That's right, Finra is an SRO (Self Regulatory Organization). In other words, they regulate and police themselves. That's little better than having The Mafia control the cops and the FBI, and then wondering why the same crimes that occur thousands of times a day go unpunished. Beginning to see the magnitude of the failure, and how sweet life is when you're part of The Cabal? So, like it or not, that's why things are the way they are cannot be "fixed." Yes, this whole multi-billion dollar industry is just as simple to understand as that. Here's the medium version about why things are the way they are (the long version is here): Leaders of most financial planning software companies only care about "show me dat uber Wall Street money today," and couldn't care less if their software performs accurate functions of value, nor is good for anyone in any way - other than Broker Dealer Reps being able to use it to hard-sell life insurance company products and American Funds. They are a creature of Wall Street - and that whole thing is about doing everything legally possible to not care about anything, while screwing everyone over just to get rich quick today. So the whole money-fest between the life insurance companies / Broker Dealers / American Funds / MoneyGuidePro / the "government" (mostly Finra) is the best thing ever invented to be tall by standing on the backs of your customers to get rich at everybody else's expense. Then when the Finra regulator gets tired of their dull low-paying job, their reward for doing their part in keeping The Cabal intact, is a cushy six-figure position with full perks in a corner office suite at AIG. So it's a revolving-door of cronyism in Wall Street, just like government politicians everywhere. That whole love-fest is a symbiotic relationship that has resulted in expensive fake financial software that's nothing more than flashy sales tools. Zero beef, all fake and fancy colorful fluff, and the government has been pressured into making it all just fine. The most profitable business model for them (considering BD Reps are by far the biggest market) these days is to put everything on a cloud-based server, and then charge 100% annual renewal rates. Little problem with that - it's just not possible for a cloud server to perform the required complex financial calculations that will produce accurate financial plans. It's not possible to code it in the first place, it would be too expensive to maintain, it would take way too long to calculate, be too "hard to use," no server would be able to handle more than a dozen users at a time, and it would constantly break and fail. To make that work would require resources on the scale of the Manhattan Project. Morningstar tried to make the Holy Grail of Financial Software in their market (Direct) and they failed spectacularly - and still are going on over ten years into it. So in order to profit, they'd have to charge $10,000 a year. Nobody is going to buy that, nor wait for more than a second without throwing a tantrum when "the internet is slow." This is because the cost of such a magic server that could handle this level of workload (and the army of way too-expensive programmers to maintain it) would be so many gazillions of dollars, that "show me dat uber money today" can't happen. For the money-fest to continue, they'd have to charge $25,000 a year. Nobody will buy it over $5,000. This explains why NaviPlan changes ownership almost every decade like a hot potato. Since estate planning went away (thus greatly reducing the need for NaviPlan), the choice is to perform actual work and get a good plan using NaviPlan for $2,200+, or fake it using MoneyGuidePro for a grand less. The average BD Rep is thinking, "Hmmm, with NaviPlan, I have to spend more money, think, be an actual professional, do more work, have to actually Fact Find to determine what's suitable for the client, know how to work a computer while sober and think with an already virtually non-existent attention span, and earn my income for a change by making an actual financial plan. Then because I'm too lame to read their software directions, I'll be on their support line forever - if they even bother answering the phone at all, OMG!!! Or I could just change my business model to "faking it." Then I can use MGP for a grand less, not have to use my brain nor do anything "hard" to earn my money, save time, my BD life insurance company overlords will be appeased, and I'll make more money. What a no-brainer!" So that answers why MGP has been taking market share from NaviPlan since 2013 (when the need for estate planning ended for most people). As time goes on, everyone becomes dumb and dumber, so the money software they are able to use needs to be dumbed-down more and more just for them. So NaviPlan is even doing that now. Around 2014, Advicent started making their own dumbed-down "lite" version of goalware - just to survive after those back-stabbing good 'ol Cabal boys that used to invite them to the money-fest orgies double-crossed them. With cloud coding, there is usually little-to-no transparency, control, flexibility, truth, accuracy, power, or control of printed reports. This is because all of that takes actual computing horsepower that cloud servers cannot yet provide. The whole cloud thing is about reducing expenses to the bare minimums, not increasing them. So everything to do with that is about making it go faster by cutting corners, cheating, lying, omitting, erroring, and just faking it. If it were performing financial work of value, then it would be so slow that users would whine. The only way to fix that would be to spend gazillions on faster better servers. This would cut into the software vendor's profits too much, and we can't have any of that (because their services and profits are required to keep the Cabal's money-fest going). So thereyago - mystery solved: Cloud servers can't perform financial functions of value because that takes too much computing power, which takes too much time and costs too much work and money. This defeats the original purpose that led the leaders of the goalware firms to do all of this in the first place - to profit today at everyone else's expense, and to be a player in this Wall Street money-fest Cabal. So everything on the software side is dumbed-down as much as possible to spit out ANY number in the least amount of time - fake or not. As long as it sells that annuity TODAY - then it's a win for everyone. So the end result is all of this $1,500 to $3,500 a year goalware. It even has brand names - goal focused / goals focused / goal-based / goals-based / goal this that and the other - basically every way you can switch up the word "goal" without violating the other fake software vendor's trademark. All fake, too expensive, and should be permanently banned; all because that's what financial advisers are forced to buy from their Broker Dealers to make those short-term commission quotas today - or be fired tomorrow as a total loser that couldn't make it on Wall Street. In case you still don't get it, here's how this good 'ol boy Wall Street Cabal works: The big life insurance companies own the big Broker Dealers. So they get to force their army of salespeople (Finra BD Reps) to go out and hard peddle mostly life insurance company products - like whole life insurance and annuities. They do this by forcing Reps to buy and use goalware, like MGP. They do this by only "approving of" MGP. The Broker Dealers run Finra. That's right, the "cops" are allowed to govern themselves, whowuddathunk? This is because Finra is an SRO (Self Regulatory Organization). Finra is comprised of "members." These members are the Broker Dealers. Since most of the big BDs are really just minions of the life insurance industry, the bottom line is that the life insurance industry controls and runs Finra. This is just like primitive corruption cronyism of Russia, China, and North Korea. Whatever feeds the fearless leaders and keeps them in power, their money-fest the best fed, and ensures no possible changes can be made to The Cabal is what works best on Wall Street. That's the way it has always been, it's the way it is now, and it's the way it will always be. The BDs and the life insurance companies then get with the current "financial plan software" vendor that has the best chances of moving the most in life insurance company products, and American Funds. Before estate planning died out, they were pouring dozens of millions into NaviPlan. This is because estate planning was all about selling massive amounts of whole life insurance and annuities. Then estate planning died out in 2013 via the new tax laws. So they stopped funding NaviPlan, because that whole business model ran its course and is no longer the best way to feed The Cabal. So without this free pile of money constantly feeding them, NaviPlan has been struggling to survive standing on its own. So now they're making goalware too. The BDs and the life insurance companies still need to keep that money-fest going, so they needed a new software platform to keep their commission-based products moving. So the best option was to shun NaviPlan and start supporting MoneyGuidePro. So they (the BD-life company Cabal) do everything they can to only "approve" of MoneyGuidePro for their sales force to use. Then since they control Finra, they pretty much told them that MoneyGuidePro is what they need to support - regardless of the harm it's causing to the investing public. How can you tell? Because Finra won't review financial plan software if it has a Monte Carlo simulator. Except, if it's MGP, NaviPlan, or a vendor friendly to The Cabal. Then that rule of disavowing Monte Carlo is ignored. So all attempts to get Finra to "do something" about the fraud that is MoneyGuidePro fails. If you don't believe this, then contact Finra and ask to talk with the people in charge of dealing with money software that BD Reps can use. You will experience the ultimate in government employees running away and hiding for cover, obfuscating, pretending to not having a clue about what you're talking about, getting transferred to voicemails that are never answered, passing the buck, pointing you in other directions, and basically doing everything they can to get you to just give it up and go away. You will get zero straight answers 100% of the time. Regardless of what you do, you will get nowhere - unless you are inside The Cabal itself. This is easy to prove - just contact them and see for yourself. This is one of the last bastions of "legal evil" in America that cannot ever be "fixed." In just about everywhere else in America where this type of Cabal is exposed, it's usually gone within a decade. That's not going to ever happen with Wall Street. They have ALL of the gold, power, and money and that is just the way it is and there's nothing anyone can do to change that in any way. Then American Funds is also in this Cabal, as the preferred commission-based mutual fund provider. If the customer won't be hard-sold into buying a life insurance company product, then they have to buy something. That something is commission load sales charge on mutual funds. What feeds the money-fest the best is to have one good 'ol boy to fill this roll, and then use their profits to fund the pool of money they need to swim in. This has been American Funds since the early 80's. Then to keep the number of players in The Cabal's inner circle of trust's to the minimum, there can only be one (just like with the ONE "preferred" software vendor - MGP). So this ONE is American Funds - always has been, is now, and always will be. Then the Certified Financial Planner program now allows MGP to be used to create the final financial plan needed to graduate. Basically the outcry of people too dumb to use actual financial plan software to make an actual financial plan was so great, that the world's main formal educator in making financial plans had to capitulate to this absurdity. They had no choice because their students are so dumb, that they'd fail to create an actual financial plan using real cash flow-based software. Then they'd fail the whole program. The outcry from all of these failed students was and/or would be just too much to deal with. So they just capitulated and are letting students use goalware to cheat their way into passing their final Bar Exam. That's how bad things have become. You'd think that a CFP graduate would be competent in making financial plans. WRONG! That hasn't been so for at least seven years now. So thanks to The Cabal, everyone is so dumb and the system is so broken, that this group of so-called industry-leading professionals are not even barely competent at performing their primary functions anymore. CFP candidates spend all that money, endure the screening and work requirements process, and go through that whole two plus year ordeal to become "certified," and then they can't even perform the main function they became certified to perform! The administrators of the program don't like it either, but they're powerless to do anything about it, because as the comedian says, "You can't fix stupid!" Everyone just agrees that this is a problem that can't be solved, so it's swept under the rug in hopes that nobody will talk about it. So nowadays, even CFPs are "fake" financial planners that fail to create financial plans. So their certification becomes more meaningless by the day (which was reason #176 that I voluntarily relinquished my marks in 2003). Everywhere you look, The Cabal has all of their bases covered to ensure that the life insurance companies control most everything in the financial services industry. All public cries to the government fall on deaf ears, because doing anything about anything would require one of these players in The Cabal to be decoupled from the orgy. If any one of them were to leave the party, then the whole Cabal would fail the other four players. Then to complete this money-fest circle of feedback loops, the generic government bureaucrats and politicians (Congress) are "paid off" to do everything they can to ensure that nothing in this Cabal ever changes. There's plenty of gold to go around, so political contributions are in the billions annually to ensure nobody even knows about The Great Wall Street money-fest Cabal - that have kept them all uber rich for all time, and everyone else permanently and uber screwed. The average citizen knows deep down that "Wall Street is rigged to screw the little guy," but they don't know the actual mechanics of how this is actually done. So this is just one example. Why would the politicians care if the public is angry about all of this? All they care about is getting re-elected. The free uber money from this Cabal is plenty to fund their election campaigns, and to defeat everyone that opposes The Cabal. Once you have the money needed to win elections, why care about what the electorate wants? They're not the ones feeding you enough to keep you in power, so what they want doesn't matter. All that matters is not biting the hands that feed you. This is just normal life in America. The image below shows an example of MoneyGuidePro's deceptive business practices. What they're doing here is pretending their software is not fake, and then trying to get you to believe that the US Department of Labor "approves" of MGP's "quality financial planware." Just a few minor issues with this top-level deception: First, in order to create a financial plan, one must use actual financial planning software. This means one has to either use our IFP, or NaviPlan, because MGP is the leader in goalware, and thus is incapable of producing an actual financial plan - even a "low-quality" plan. MGP is not financial planning software, so it's not capable of producing even a low-quality financial plan. Next, a quality financial plan can't be created unless the user accounts for all of the mundane details that are needed to create a real financial plan. Little minor details like inputting budget and cash flow incomes and expenses, accounting for annual surpluses and deficits and replacement costs, performing an actual investment risk tolerance test instead of having a BD Rep randomly move a meaningless slider, and an endless of critical Real World variables that MGP just completely ignores. Next, they may be surprised that the government is not is as oblivious, nor as easy to get to rubber-stamp approval of Wall Street shenanigans, as they have been in the past. What they're doing here is thinking that, and hoping that, the government remains oblivious to reality, and just keeps believing that MGP is actually financial plan software. This time may be different. The government may have grown enough brain cells to finally get it on this round of at least attempting to actually do something to fix all of these massive failures. In which case, someone with the required attention span will eventually get around to calling shenanigans, and banning goalsware software completely. All one needs to do is read the image below, figure out how MGP actually works, and then it should be obvious that the two things are diametrically opposed to each other - and thus the text in the image is just a big fat lie that needs to go the way of the dinosaurs. MGP is the kind of software that is THE epitome of what the government needs to ban, if they want advisers to start acting like fiduciaries, instead of used car salesmen. So MGP is trying every dirty trick in the book to deflect attention away from the fact that DOL is out to change the color of advisers' hat from black to white. MGP is the #1 "enabler" in the industry that allows advisers to keep their hats as black as possible. In other words, if MGP was banned, more than half of unsuitable investment recommendations (if you want to call life insurance company products investments, which is laughable), would magically vanish overnight. So they have a team of high-paid marketing lobbyists pulling out all the stops to ensure these deceptions continue to wreak havoc on investors for all time. And they're the best in the industry too. You probably have read this and thought, "Okay, so MGP is working with the DOL to ensure it makes quality financial plans that meet the new fiduciary standards. What's unusual about that?" HA!!! If so, then that's an example of how good they are at pulling the wool over your eyes. If they can deceive you, then also deceiving the failed government just happens by default. They're not doing anything to work with anyone. All they care about is that the new DOL Fiduciary Rules won't affect them at all. That's the main goal they're trying to accomplish. And they'll probably succeed too. In this case, they're just pointing to a sign that says, "Nothing to see here, move along," and hoping that the DOL reads it and thinks, "I don't know squat about financial plans, let alone the difference between a low-quality and a high-quality financial plan. C'mon, I'm just a government employee with zero financial skills, education, and experience! MGP is bold enough to put a big thing on their website boasting that their software makes quality financial plans. I guess it must be true, so I'll just move along and look for something else to whine about elsewhere." They think the government is so stupid, that they'll just read the sign and move on. They may be right, as this is what always happens when they try to stop Wall Street shenanigans. Wall street just outthinks, outguns, and outspends them, and thus gets whatever they want, most every time. Critiquing their text: No MGP cannot help, it can only hurt. There's not one thing that MGP does that a true fiduciary would approve of. What's the source of this "recent survey?" C'mon, it's MGP, there's no survey. They just made it up, it's just a fake falsehood deception, just like everything else they do. Then they left out by far the #1 obstacle to "creating a financial plan" in the Real World in their pie chart. Creating an actual financial plan is hard work, and advisers (especially BD Reps) just do not perform any kind of hard work anymore, period. Since the beginning of time, they've just gotten used to the fact that any and all deceptions can be used to move life insurance company products, using minimum work and maximum shenanigans, regardless how Black Hat they are; and everyone thinks it's just fine. Well, those days are slowly coming to an end, with the new DOL Fiduciary rules being hopefully the first step. That's THE problem in the industry since '05 or so. If there's any actual work / time / thinking / attention span / skills or education required, or reality involved, or any "knowing what you're doing;" then the average financial adviser will just say no. Why? Because they don't have to. Why work when you don't have to? Nobody is forcing them to perform actual work. Nobody has in the past, nobody is now, and more than likely, nobody will ever force financial planners to actually be financial planners in the future. These days financial advisers are too dumb, broke and broken, sleep-deprived, confused, lazy, technically challenged, and incompetent with near-zero attention spans, to create a financial plan - even a non-quality financial plan. BD Reps demand goalware that will allow them to make commissions while performing the bare minimum of work, while making it look like they actually did some work to clients. This is what MGP specializes in - the great "Quality Financial Plan Deception." Nobody does it better, and it's just the end result of letting all of these massive government failures fester since the beginning of time. All of this is just as simple and easy to understand as that. THE PROBLEM, is when a financial adviser "makes a financial plan" for a non-retired client, it doesn't have accurate numbers. A financial plan created via goalware is not a financial plan. The word "plan" is in the string "financial planning software" because its accurate numbers track reality enough to allow one to make realistic plans for the future - as a human in the 21st century here on Earth - not on BizarroWorld. Goalware is not capable of performing that valuable function. It's just a fancy way of estimating how much money it costs now, or in payments, to reach a future goal(s). EVERYTHING else is in the "plan" ignored. Other data is usually inputted, but it's not used in the calculations for anything meaningful. You just "can't do that." Therefore, a new name should be created for goalware, and the fake financial plans they create, so they can be distinguished from actual real financial plans. So the DoL needs to do that too. All that needs to be done is make up a new name for goalware and fake plans so investors and consumers will know the difference. Just like hedge funds - they started out doing what they were supposed to do, which is hedge. Then the Black Hats smelled the money, deregulated, and morphed them into a Wild Wild West free for all that ending up as yet another huge financial services debacle just waiting to help end the world, again. All that needs to be done is make up a new name for the fake hedge funds, and there wouldn't be anything to whine about. Why? Because if you renamed them "Casino gambling funds for stupid rich people," then even the dumbest rich person would think twice before investing. There's no way to tell the difference (because if you call and ask them, they will lie and say they hedge), so stupid rich keep people falling for their shenanigans, and lose billions annually. The same concepts should apply to financial plans, financial planning software, and financial planners. If goalware vendors, and the BD Reps that abuse them, were to rename their products to what they really are, then everyone would know what they're buying, instead of buying an empty bag with a bill of goods inside. Instead of calling their software "financial planning software," it should be called, "goals-only software" or just "goalware." Instead of calling their reports a "financial plan," they should be called, "goals-only estimation reports." Instead of calling themselves "financial planners," they should call themselves, "goals-only financial advisers." Etc. and so forth. Just call things what they really are, and there would be much less to whine about, and things for everyone would be much better. When using goalware, it's okay to say, "This is what it's going to take to reach your goals." What's not okay is saying, "This is your financial plan, a roadmap of what your financial future will probably look like." This is because goalware is not capable of projecting financial futures. That's not what it's programmed to do, so it cannot perform those functions. All it can do is dress up various ways of presenting how much money it would probably take to fund goals. Therefore it is a deception - with goalware the client was told they were getting a financial plan, and they did not. What needs to be whined about until fixed, are these life-ruining deceptions from "professionals" extracting maximum income from their clientele. So just wrap, label, and call things what they really are, and that would fix that. Then clients would be getting what they paid for and thought they were getting, and not a fake version, that could "ruin their lives." If that were done, then investors could better choose which type of adviser they want to work with, which would stop dozens of thousands of American lives being ruined annually by Black Hat "financial advisers." The bottom line is ALL of the numbers are from BizarroWorld using goalware. So all of that needs to go the way of the dinosaurs ASAP. So the new DoL Fiduciary Rules are just the first step in finally, after over a century of Wild Wild West shenanigans on steroids, attempting to at least do something about these deceptions, instead of nothing since the beginning of time. So look for more and stronger rules and regulations to come over the years. Over time, the government will eventually force financial advisers to knock it off with their Black Hat shenanigans, and will force everyone left to wear a White Hat. There won't be many Black Hats left either. Why? Because the vast majority of "financial advisors" are just Black Hat life insurance company product salesmen - that are dropping like flies. Most are just in it for the big easy money, and couldn't care less about the well-being of their clients. If they can't use goalware to dupe their sheeple into giving them big easy money, then their job will become "too hard" for their pea-brains to process, and they'll eventually just quit on their own. That's the core of The Problem the DoL is trying to fix: Dummy financial advisers that should not be allowed to practice, and need to go back to their day jobs of asking their customers if they want the meal or just the sandwich. That's what this website is about - selling 100% White Hat actual real financial software to people that want and need real numbers to work from - not fake fantasy from BizarroWorld, just so "financial planners" can get rich peddling life insurance company products at the clients' expense. So over time, financial software vendors like us will prosper, and goal-whatever vendors like MGP will wither and die. So thereyago, that's how all that works. So until and unless the government finally wakes up and says ENOUGH WITH THESE FINANCIAL SHENANIGANS, and actually does something about these colossal species-level failures, that's in direct conflict with the best interests of investors, then it's just going to be like this forever. So anyway, that's why things are the way they are and can't be fixed: Wall Street can't survive in its current form without these interlocking conflicts of interests, and then paying off the politicians to ensure nothing ever changes (and so they can get bailed out with your tax dollars because they grew out of control into being world-eating monsters that are "too big to fail"). So best of luck to you with all that. Just wanted to point out that if you buy MGP, or buy into any American Funds and/or life insurance company product sales schemes by "financial advisers" using MGP; then you are a critical part of "the problem" of why most everything is hopelessly broke and broken in the financial services industry, why it just keeps getting worse all the time, and why it can't be fixed. So a bottom line is that if you're an investor, and you buy into anything any so-called "financial adviser" proposes via software called MoneyGuidePro, then you are playing your part as "sheeple" and are responsible for feeding this Cabal. The lesson here is the same with the banks: If being in the boring mundane life insurance industry is not profitable enough for you, then get out and run money like everyone else! Do not use the public's most trusted source of mega money to bank roll your adventures just so you can get your multi-gazillion dollar bonuses. Banks should make loans (like they used to - not just mortgages, auto loans, and credit cards @ usury 36% APR), manage checking and savings account, and sell CDs, and that's all. The commission-based Merrill stockbroker sitting in most Bank of America branches next to the loan officer needs to go to way of the dinosaurs ASAP too. Life insurance companies should sell life insurance and annuities, and that's all, period, full stop. Anything more than that are just shenanigans, and needs to be spun off ASAP. Feeding it allows their Cabal to grow into world-eating monsters that result in gazillions of your tax dollars going to bailing these fat cats out when they fail. Not "if" they fail, but "when" they fail, again. The whole thing is a "species-level failure," so count on it to fail spectacularly over and over and over again (while the same Wall Street good 'ol boy fat cats get to keep all of your hard-earned gold). In other words, you're just "doing it" to yourself. So just don't do that! Just say no as soon as you hear any of the following words: MoneyGuidePro, whole life insurance, annuity, or American Funds. It's just as simple to understand as that. If you're an adviser working for a life insurance company controlled Broken Dealer, then this is the best way to escape. Links to Learn More Read more about the subject, by learning about the leader in these goal-software shenanigans Goalware is driven by the life insurance industry, which helped all of this play a major role in The Great Meltdown |

Financial Planning Software Modules For Sale (are listed below) Financial Planning Software that's Fully-Integrated Goals-Only "Financial Planning Software" Retirement Planning Software Menu: Something for Everyone Comprehensive Asset Allocation Software Model Portfolio Allocations with Historical Returns Monthly-updated ETF and Mutual Fund Picks DIY Investment Portfolio Benchmarking Program Financial Planning Fact Finders for Financial Planners Gathering Data from Clients Investment Policy Statement Software (IPS) Life Insurance Calculator (AKA Capital Needs Analysis Software) Bond Calculators for Duration, Convexity, YTM, Accretion, and Amortization Investment Software for Comparing the 27 Most Popular Methods of Investing Rental Real Estate Investing Software Net Worth Calculator (Balance Sheet Maker) and 75-year Net Worth Projector Financial Seminar Covering Retirement Planning and Investment Management Sales Tools for Financial Adviser Marketing Personal Budget Software and 75-year Cash Flow Projector TVM Financial Tools and Financial Calculators Our Unique Financial Services Buy or Sell a Financial Planning Practice Miscellaneous Pages of Interest Primer Tutorial to Learn the Basics of Financial Planning Software About the Department of Labor's New Fiduciary Rules Using Asset Allocation to Manage Money Download Brokerage Data into Spreadsheets How to Integrate Financial Planning Software Modules to Share Data CRM and Portfolio Management Software About Efficient Frontier Portfolio Optimizers Calculating Your Investment Risk Tolerance |

© Copyright 1997 - 2018 Tools For Money, All Rights Reserved