About "Investing" in Fixed Annuities |

| Site Information (is listed below. The financial planning software modules for sale are on the right-side column) Confused? It Makes More Sense if You Start at the Home Page How to Buy Investment Software Financial Planning Software Support Financial Planner Software Updates Site Information, Ordering Security, Privacy, FAQs Questions about Personal Finance Software? Call (707) 996-9664 or Send E-mail to support@toolsformoney.com Free Downloads and Money Tools Free Sample Comprehensive Financial Plans Free Money Software Downloads, Tutorials, Primers, Freebies, Investing Tips, and Other Resources List of Free Financial Planning Software Demos Selected Links to Other Relevant Money Websites

|

There are Fundamental Flaws in the Logic of Investing in "Safe and Guaranteed" Fixed Annuities

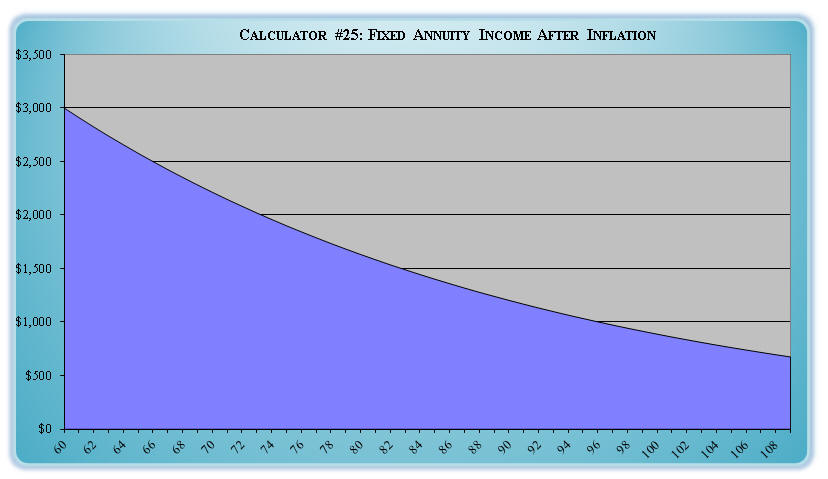

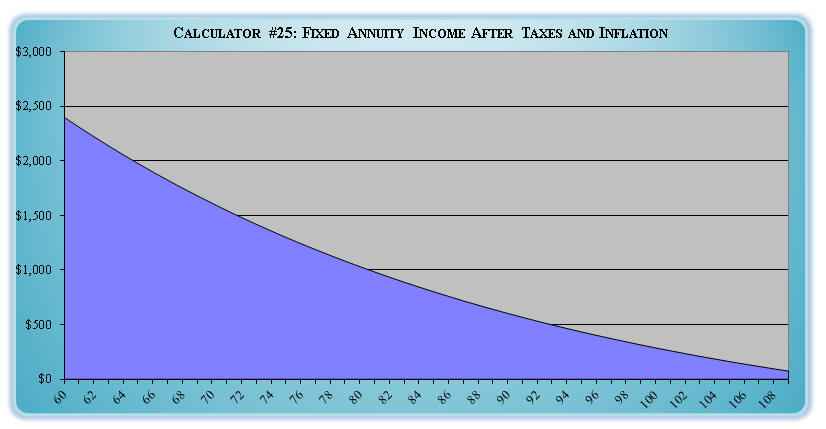

Here's brutal life lessons from the School of Hard Knocks to keep in mind, when your life insurance company agent is trying to get you to buy a safe guaranteed high yield for life fixed annuity. When your agent says, "With this wonderful new fixed rate annuity, you'll lock in a 3% safe and totally guaranteed yield for life! Better sign up today before they lower the rate again!" You'll think, "Wow, what an awesome deal, I'd better jump on that today so I can lock in that super-high ultra-safe yield!" If so, then you're just a sheeple asleep at the wheel, and didn't do your math homework yet. Fixed annuities are "bad" in most situations, and should be avoided. Why? Annuities, and whole life insurance, come from the same place - the life insurance industry. So they suffer from the same enormous and ubiquitous problems. So this page is about that. If you don't own a fixed annuity now, then this page will help explain why you should just not do that. The guaranteed safe income stream for life is the one and only advantage of fixed annuities, because it's the only financial product that performs this function. The other advantages are too insignificant to list (and mostly have to do with needing a bell or whistle). The list of major disadvantages far outweigh the one, and then the very few minor advantages. The biggest reason to avoid them is because they are an expensive investment vehicle to own. The only other type of "investment products" that are more expensive are variable annuities and whole life insurance. For the rest of this page, all life insurance company loads, commissions, fees, expenses, and charges will just be referred to as "fees." Fixed annuities have other problems as well: They're not standardized, liquid, nor uniform; and they have expensive bells and whistles (AKA insurance riders) that hardly anyone understands, are seldom used, fail when needed (because they don't perform as advertised when executed, because of the "fine print"), and are rarely worth the money (premiums) paid for them. Fixed annuities also pay life insurance agents the most money in commissions per buck invested, compared to every other type of non-life insurance financial product a financial salesperson can sell today - except variable annuities. So they have the most incentive for abuse and to be oversold, just to maximize agents' short-term incomes. This is why you're always hearing and reading about them. Annuities were not the rage before loaded mutual fund commissions dropped from 8.5% to 5.5% (and the whole limited partnership industry evaporated because of tax changes from TRA '86). Then a decade later, the Internet came on online, and then discount brokers popped up everywhere, making it so investors could easily just DIY (do it themselves). In other words, the Internet and progress in general, made it so financial salespeople couldn't get rich anymore by using good 'ol mutual funds, starting in the late 20th century. I know, because I was one of them, and that's one of the primary reasons I gave it up. For example, in '88, when I sold $10,000 worth of mutual funds; after the BD ate half of my commissions, I made $425 before taxes. Then around 1990, more mutual fund families came online with lower loads. So the mutual funds I was selling dropped their commission rates from 8.5% to 7.5% to remain competitive. So I only made $375 for selling the same deal. Then in '92, it was $325. In '96 it was down to $275. This 35% pay cut in less than a decade was in addition to high cost of living inflation, and was totally beyond my control. So I, and everyone else said, "If this keeps up, then I'll be working for minimum wage, so it's time to bag this deal and move on to something more profitable." That something for me, was bagging being a commission-based product peddler altogether. But for the career peddler, the only options left that "paid anything," were annuities and whole life insurance. There were literally no other options, after limited partnerships went the way of the dinosaurs, and because stock trading commissions (AKA individual securities) were falling at the same rates. Then no other product has yet to come online that "pays anything." So annuities and whole life are the only financial products today that pay a decent commission to agents. This is the one and only reason why they are so highly recommended by "financial advisers." It's just as simple as that. Other common problems with fixed annuities are: • High internal fees. • Being stuck in them because of paying the high initial fees to buy into them. • Having to pay high surrender fees to liquidate them. • Very high taxes to pay during the withdrawal phase to make up for the very much less than you think taxes on dividends and interest saved along the way. • Contributions are not even tax-deductible, like they are with traditional IRAs and 401(k)s. So annuities sort of work like a Roth IRA, until you withdraw money from it. Then you have the huge drawback of a traditional IRA (because withdrawals are usually taxed at ordinary income rates). • If you sell it before you're 59½, then there are substantial tax penalties. • There is no liquid market to sell them after you sign their contracts and pay. Only the life insurance company that sold the annuity to you can "buy it back." Then this takes a major legal war - where you'll have to find, hire, and deal with a law firm that does little-to-nothing but this type of work. Then they'll want a huge part of your settlement, which is usually limited to your original investment. Then these cases rarely win because they'd need to prove the agent wrongfully took advantage of someone unsuitable with "limited mental capacities," just to make a quick buck. That pretty much describes every annuity sale. So these cases rarely go anywhere. The legal system says that you should have "caveat emptored," while you had the chance (during the free-look period). You were asleep at the wheel when that happened; so you snooze, you lose. In general, whenever there's a "contract" involved when it comes to investing, you should always just say no. Any form of a contract means little-to-no liquidity, they hold all of the cards, and the house's deck is stacked against you. They know you're too slow and stupid to learn how these products actually work during the free-look period, so once that's over, and you wise up and want to back out, they have a signed contract specifically stating that you cannot do that. That means you're stuck like a fly in their spider's web, totally at their mercy while they suck the life out of you little-by-little. • You're still stuck with MDIB / RMD / MD Rules (where the IRS forces you to withdraw money when you reach 70½, so it can recoup the insignificant taxes you've saved in the past). The life insurance company basically just keeps a quarter to a third of your money, compared to intelligently investing your own money, for no better reason than they can, and because that's the foundation of their profit-generating business model. Fixed annuities are a tax-qualified product, meaning once you buy it, you're basically totally stuck until you're retired (age 59½). You can't sell it, nor get income from it until then without severe taxes and penalties. Then even if you chose to endure the taxes and penalties, you'd get dinged again with all of the usual life insurance company early surrender penalty fees (which could be as high as 10%). So if you buy a fixed annuity, realized you failed, and then want to get out of it soon after you buy it, over a third of your money could just vanish for no good reason. So fixed annuities are the investment vehicle that results in you being more "stuck" than just about any other. The only investment product that's worse in this regard is a variable annuity. Even with whole life insurance, you can become unstuck by just stopping paying premiums, and then it will eventually die a natural death. Only the spider benefits from you being stuck like a fly in their web. Here's what we've seen after observing this fiasco for over three decades in the Real World: • The #1 reason investors can't reach their retirement goals is inadequate savings over the last decade before retirement. • The second biggest reason is being stuck in poorly-performing life insurance company products for decades. • The third is lack of asset class diversification (having too much money in one asset class, usually real estate). • #4 is being done in by a major crisis - divorce, unemployment, uninsured death, jail, accident, injury, lawsuit, or not having adequate health, disability, or long-term care (AKA nursing home) insurance. • #5 is being locked into a having a lifestyle that costs too much for no good reason. • #6 is thinking that you, or your money manager, has magic powers that can quickly profit greatly by timing the markets using stock and/or ETF trading. • #7 is being duped into migrating with the herds of sheeple blindly following the current investing fad (usually via stock market TV shows - AKA "armchair investing"). Not buying an annuity is the main financial disaster that you can easily choose whether or not to avoid. This is because you can realize you're failing with the other methods of failure, and then just stop doing that, and then start doing better things that fail less. But once you sign any life insurance company contract, you are usually stuck with it for life with no hope of ever escaping. So the second biggest reason people can't retire the way they expected, is because they got stuck using life insurance company products, that didn't perform nearly as well as expected. Even if they played out "as expected," then you'll still lose, compared to the many more efficient and modern methods of investing. Then once your money is in the clutches of a life insurance company, there's usually little-to-no way out without taking a substantial loss in one way or another. Then when it comes time to start withdrawing retirement income to spend on living expenses, it's usually around a third less than you expected. There is just no way you can win the money game with any form of annuity product, period. Life insurance companies never had any good deals for investors (AKA their policyholders) in the past, they do not now, and they never will in the future. It's just as simple to understand as that. The first fundamental flaw in fixed annuity logic is this: When investors hear the words, "You'll get a 3% guaranteed fixed interest rate locked in for life," what goes through their minds is bank math and logic. In other words, if you invest $100,000, then this time next year you'll have $103,000 (or $100,000 with $3,000 of income to spend). This is NOT how anything works in the life insurance world! First, this 3% yield is only applied to the net amount of money that gets invested into their general account after the life insurance company deducts their fees. Then it usually doesn't even apply to the total return before annuitization. Once the net proceeds get invested into the general account, then it usually earns the 3% guaranteed fixed interest rate. But then the life insurance company usually deducts fees from it, so a little is shaved off annually. So if they do, then this is just part of the sheeple fleecing. The minor fleecing occurs during agent commission-paying and pre-annuitization interest crediting phase. Then the major fleecing occurs when the bells and whistles (riders) all add up. Then the slaughter mutton fest happens during the annuitization process. Your agent will usually be making an immediate 2% - 12% up-front commission. So this in most cases is even higher than the highest front-end loaded A-share mutual fund. This money is just gets shaved right off the top of the check you wrote out. Then the life insurance company has to make enough profit to sustain its business model, which is 100% based on maximizing value and profits and dividends for their stock shareholders; and not policyholders (you). How do you think they can afford billions in TV ads, own the most expensive gold-plated ivory-tower office buildings - fully-staffed with uber-expensive full-time employees with full-month-long vacations and lavish benefits, with the never-ending parades of conventions and award ceremonies for the highest producing agents, retreats, high dividend payouts to shareholders; and just constant decedent parties? Then grew up to be "too big to fail" and had to be bailed out with taxpayer money - like AIG, American International Group, which needed $182 billion to survive in Great Meltdown of '09? This mega money doesn't just magically appear from nowhere, "Wall Street financial innovations," nor brilliant management. It just comes right off the top of the check you wrote to them. The life insurance company business model is not a pretty one, unless you're an agent, employee, or a stockholder. So a bottom-line is when you look at this "wonderful 3% safe guaranteed yield for life," relative to the amount of gross check you wrote out, it can be as little as 2% - 2.5% (or 15% to 35% less than advertised). This is about the same interest yield as bank CDs, that also have just about as much in "safe guarantees." Then (compared to annuities), CDs have little-to-no restrictions on cashing out early (or you can just wait until it matures, and then you'll have all of your money back - with interest). Then because annuities are "tax deferred" you can't sell them, even if they're not yet annuitized, and/or the back-end redemption fee surrender period has expired, without paying a 10% penalty tax (if you're under age 59½). All you can do is "exchange" it for essentially the same thing. Then most of the annuity income is taxable at your highest ordinary income rates (whereas mutual fund dividends and capital gains, and bank CD interest, are usually taxed at much lower rates - sometimes less than half as much). Also keep in mind that once you annuitize the annuity (trade the market value, AKA accumulation units, in for an income stream, AKA annuity units), then you are totally 100% stuck with this for life with zero hope of ever getting anything out of the insurance company but your little paltry yield, which most of the time DOES NOT EVEN INCREASE WITH COST OF LIVING INFLATION! So when you fall for this trap, after a few years of just 2% inflation (average long-term CPI inflation is around 3%), your actual real after-tax yield is negative. After that, then you're losing 2% every year, compounded, for the rest of your life. That's right, you're safely guaranteed to be losing money, more and more every year, for the rest of your life, with all fixed annuities when the income payout doesn't increase with inflation (see the Investment Comparison product demo for an example of these numbers). For those of you that still don't get it, the cost of buying everything in your life goes up all the time, but your fixed annuity income will not (this is another reason why it's called "fixed"). So the amount you're "getting poorer by" escalates more and more every year. The pasted charts below from our unique annuity income calculator shows the long-term effects of 3% annual inflation. The annual fixed annuity payout loses half of its purchasing power in 23 years with 3% CPI inflation (17 years at 4% inflation, 14 years at 5%, and 12 years at 6%). After 3% inflation and taxes of 20%, it only takes 17 years to realize half of your income vanishing. In 51 years, your real income is effectively gone. So you can see better, they can be downloaded from here and here.

Inflation is a force of nature that will never stop, so if your fixed annuity is funding a large portion of your living expenses, unless you have other resources; then eventually it's probably going to be back to, "Do you want fries with that?" until you croak. You'd be mad as hell if your Social Security paycheck did not go up every year with cost of living inflation. So you should be just as mad when this happens with fixed annuities. Then if you buy any kind of an "inflation COLA (cost of living allowance) benefits rider," which makes the annuity paycheck increase with annual CPI inflation to cover this guaranteed risk of losing your money, your net yield will drop around 10% to 30%. This reduction in retirement income is due to the amount of premiums paid to buy the income inflation rider - plus all of their built-in fees. Then if you die, the life insurance company keeps it all (whereas if it were invested in anything else, your heirs would just inherit it). If you're thinking that this works just like Social Security, then you are correct. When you apply for benefits, government actuaries are just buying you a fixed annuity with a COLA rider with your FICA tax money (and if you're married, then a joint or term certain rider too). Then if you want to counter this risk by buying some kind of payout option where the income goes to someone else when you die (AKA survivor options and/or term certain riders), then this will also cut 10% to 30% off of this wonderful safe guaranteed yield for life. So if you buy insurance coverage for both of these bad things that ARE GUARANTEED TO HAPPEN (inflation and losing everything when you die) on a 3% fixed annuity, the actual yield on the amount you wrote the check out for could be lower than 1% (or up to two thirds less than advertised). So no matter how you look at it, the only ones that are not guaranteed to lose out big time with any form of annuities are the life insurance companies, their stockholders, employees and agents. Everybody just needs to wake up and smell the reality of the life insurance company business model. There is NO FREE LUNCH, nor are there any "good deals" with any life insurance company product. There never was, there aren't any now, and there never will be. They employ armies of the world's smartest and most expensive money rocket scientists (AKA actuaries) to ensure this is always so. Regardless of whatever you've been told, or whatever you think, you cannot "win," ever with any product from any life insurance company (other than buying term life insurance, and then dying by accident). So if these deals are so "bad" then why are they always touted as being so "good"? Reason #1 is that nobody has ever performed this simple math, and then published the results in a place that stays put, before this page. Next, fixed annuities are just the one and only way life insurance agents can survive and feed their families when the markets are down, and when old retired sheeple are stuck frozen like a deer in headlights by news events, and are afraid to invest in America. When this is going on, then there's literally no other product agents can move enough to meet their sales quotas, so they won't get fired. This is why fixed annuities are always the current investing fad when markets are down, flat, or volatile; and/or when CDs and bonds aren't yielding anything (which has been the case since 2002). So when you see fixed annuities advertised everywhere and talked about by everyone, it's not because "they're on sale" or are a good deal now. It's only because financial salespeople know it's the one and only decent-paying commission-based product that sheeple will allow themselves to be talked into buying - today. If advisers could make a decent buck from selling you a long-term 3% CD, then they would be doing that instead of peddling fixed annuities. But they can't. Some can sell CDs, but they'd only get paid a few bucks, so they don't do that. Then the last thing they want you to be doing is going to the bank (about the only place you can buy CDs), because then they won't be getting paid at all. White Hat advisers don't like selling fixed annuities, and some actually feel bad about it; but when that's all their sheeple will allow themselves to be fed by their shepherd, then there's no choice. If you dig deep enough into the math, details, and fine print, then you'll usually find there's a logical reason for most everything in life. This is just the way things are in the life insurance company world. It's only a mystery because they need to keep all of this hidden from you, so you'll voluntarily pay, and then stand still for their fleecings. So now you know to start thinking like a people and not a sheeple - especially when it comes to all forms of any product coming from any life insurance company. Just do the math and see for yourself. This is not rocket science. Anyone can run the numbers with a simple calculator. Just have your agent run a "ledger" that shows the estimated income the fixed annuity will pay out once annuitized, and then divide that annual income number by the amount of the check you'll write. The ledger is where the truth of reality shines bright. For example, say you want to invest $100,000 into a "3% annuity," and cover both of the major risk bases (inflation and losing everything when you pass away). If the ledger shows pre-tax income of $150 a month, then you're not realizing a 3% safe and totally guaranteed yield for life - you're only getting ~1.75% (and it's usually much less than that too, it could be less than 1%). This is 40% to 80% less than the original claim of "getting a 3% safe and totally guaranteed yield for life." Results will vary, and these numbers change daily, but the bottom-line is that once you start ignoring the hype, thinking, calculating, and acting like a people instead of a sheeple, then you'll see that all forms of annuities should be avoided like the plagues on society that they really are. So as you can see, what's really "fixed" in the life insurance world is the overall money game. So no matter what you do as a policyholder of any kind, you will always lose and the life insurance company, their stockholders, and their agents, will most always win. There's only four ways to win in the fixed toward the house life insurance company game, and that's to either own their stock (because that's where all of these ill-gotten profits from fleecing the masses of sheeple end up), be an agent or employee, or buy term life insurance and then die (from an accident). If you're now thinking, "If this is so bad, then why doesn't our always on-the-ball government do something about this scam?" Well they did, that's what the free-look periods, and annuity ledgers are for (and life insurance ledgers). The catch is that you just acted like a sheeple and totally ignored all of the important bottom-line numbers in it. Just don't do that anymore. If you're in the "free look period," then just send it back saying you don't want it. After that's over, then you're mostly stuck until you're age 60 or more (unless you want to pay the stiff surrender fees and/or the 10% penalty tax). This free look period is the government's way of protecting you by saying, "Okay sheeple, this is your last chance to wake up and cancel this bleep before it ruins your life. So you have (usually) ten days to do your math homework to figure the reality of this out and cancel, then that's it; the permanent fleecing of your nest egg will commence on day eleven." If you're contributing money to any form of annuity periodically, then just stop doing that. Yes you are "allowed" to do that. The only "bad thing" that's going to result from that, is having to endure whining from your agent and the life company. Always remember that once you sign the form to annuitize it, and start getting your guaranteed for life paycheck, then you won't be able to make any changes to anything ever, and you'll be 100% totally stuck with it for life, period full stop. How to solve most all of these retirement income problems is to use our Conservative High-income Model Portfolio. Here are Some Actual Numbers as of May '15 First, assuming a 49-year old bought a $100,000 fixed annuity, and then immediately annuitized it. Your annual payments would be around these amounts (depending on your state and your health): Single Life: $5,671. Single Life: Buying a 3% annual inflation rider lowers your yield by: 48% ($2,966). Single Life: Buying a 5% annual inflation rider lowers your yield by: 64% ($2,032).

Single Life: Buying a 25-year term certain rider lowers your yield by: 20% ($4,551). Single Life: Buying a 25-year term certain rider with a 3% annual inflation rider lowers your yield by: 50% ($2,843). Single Life: Buying a 25-year term certain rider with a 5% annual inflation rider lowers your yield by: 66% ($1,953).

Joint Life: This lowers your yield by: 26% ($4,216). Joint Life: Buying a 3% annual inflation rider lowers your yield by: 56% ($2,478). Joint Life: Buying a 5% annual inflation rider lowers your yield by: 72% ($1,611).

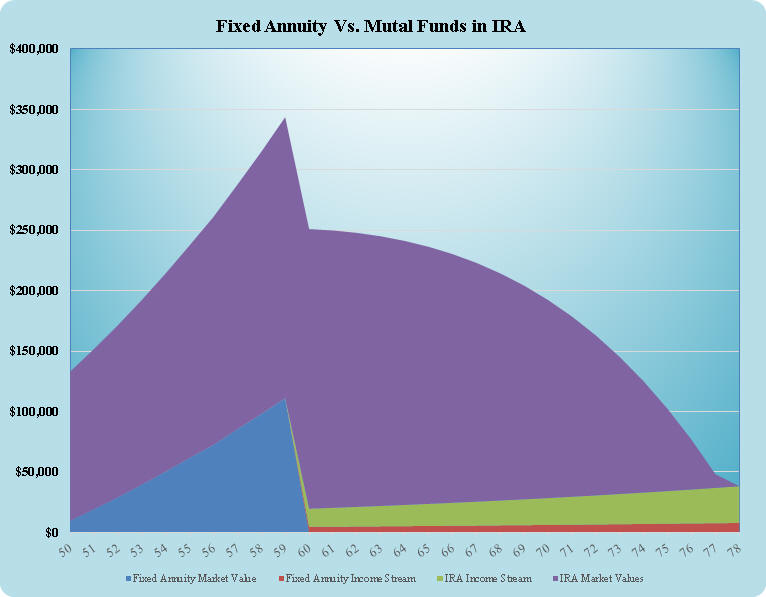

Joint Life: Buying a 25-year term certain rider lowers your yield by: 26% ($4,205). Joint Life: Buying a 25-year term certain rider with a 3% annual inflation rider lowers your yield by: 56% ($2,471). Joint Life: Buying a 25-year term certain rider with a 5% annual inflation rider lowers your yield by: 72% ($1,607). So as you can see, your huge 5.6% fixed yield goes down to 1.6%, when you insure for the huge life risks that you know 100% for sure are going to happen to you! The bottom line point is that you could have made more money, and had liquidity just by using FDIC insured bank CDs. Then you could cash in the CD at any time, and/or choose to not roll it over when it matured, eliminating being "stuck for life." This also means you could use our Conservative High Income Model at any time, and then probably do much better then both of these methods of getting retirement income. Here's Numbers from an Actual May '11 New York Life Insurance Company Fixed Annuity Ledger The ledger software used in 2015 wasn't capable of inflating contributions, so this couldn't be updated First, here's a chart from the IC demo showing the bottom lines between fixed annuity and mutual funds in a traditional IRA. This should be all the proof needed to determine which method of long-term investing is best for retirement income:

These numbers match the contributions on the Investment Comparison demo, so you can easily compare fixed annuities to other methods of investing. First, this was during a time when agents were claiming, "fixed annuities were paying 5%." Then note that the total return you'd earn while in the accumulation phase (making contributions annually to the account) on this fixed annuity, is only 1.1% for the first ten years (then 1.0% after that). So much for thinking that all of the money you save will be growing at 5%, huh? This is rarely the case with fixed annuities - the current yield touted rarely has anything to do with the actual yield you're actually getting, both in the accumulation and the distribution phases. The numbers in italics below show what you would have had if the total return during the accumulation phase was inputted as 5% on the Investment Comparison demo (instead of 1.1%, like it was). Instead of having ~$113,457, you'd have between $350,000 and $513,000 (if you did not buy the fixed annuity and your money grew at 5% instead of 1.1%). So $400,000 was used as the beginning value used to buy the annuitized annuity (Lifetime Income Annuity) in the following examples. Next, agents will pile on all kinds of other bells and whistles (riders) that will also dramatically lower your yield. The numbers below ignore all of them, so it's all just a "straight vanilla fixed annuity" with the three riders explained below. Looking over all of the fancy sales brochures that came with the ledger, there's over a dozen little riders available (and so you'll probably have several of them if you let your agent run amok). Just keep in mind that all riders are just add-on insurance contracts, that cost you big money in premiums, and that's how life insurance companies earn their massive profits. So if you got them all, your actual 4.1% (really 1.2%) yield would probably go down to under 2% (way under 1%). Here's how much these riders lower your fixed income yield: Straight Vanilla Single Life Payout (no riders). The fixed annual payment for life would be: $7,772.29. You'd get this amount until you die, and it would be exactly the same and cannot be changed. Realize that what looks like a 6.5%+ yield is really only a 1.5% yield - because the numbers are based on values of $113,000. This is because of a deception in the ledger - which will be fixed when this is updated soon. You should have received 5%, which means the initial amount annuitized should have been ~$400,000. Single Life: Buying a 25-year term certain rider lowers your yield by: 12.6% ($6,792.43). Single Life: Buying a 3% annual inflation rider lowers your yield by: 26.3% ($5,727.79). Single Life: Buying both of the above riders lowers your yield by 37.4% ($4,867.97). Joint Life: Buying a 25-year term certain rider lowers your yield by: 12.5% ($6,801.28). Joint Life: Buying a 3% annual inflation rider lowers your yield by: 38.3% ($4,799.75). Joint Life: Buying both of the above riders lowers your yield by 40.7% ($4,612.89). So you started out with a plain vanilla fixed annuity that yielded 6.9% (if you had $400k instead of $113,457, then this yield is really only 1.9%). Then if you want to "insure" for all of the three risks that are certain to happen to you in the future, then your yield drops to 4.1% (again, if you had $400k instead of $113,457 to start with, then this yield is really 1.1%). This is a 40.6% decrease in yield. Now compare this actual yield of ~1.5% to the yield and (total return) on our Conservative High-Income Model (CHIM). More than likely, just the yield is significantly more (usually more than twice as much, it changes monthly). Then realize that if the CHIM has an annual total return of 8%, and 5% is yield, then your account balance grew by 3% in that year. So next year's 5% income yield would be based on 3% more principal money than you had last year. This is how you'd get your annual cost of living retirement paycheck raise using mutual funds. In other words, this is how you'd get your "free automatic inflation rider" by doing it yourself with mutual funds. 5% is two thirds more of an inflation rider than the 3% quoted in the fixed annuity ledger. If you ran the ledger with a 5% annual inflation rider, then the payouts would drastically decline much more than what's shown in the above math. This is because if you buy an inflation rider with annual increases more than what life insurance actuaries think will probably happen in the Real World (with CPI inflation), then the rider premiums will escalate so much that you won't believe it. This will result in your yield being close to 0%. This "income growth" is guaranteed to never ever happen with a straight vanilla fixed annuity. Granted, the CHIM can and will lose money in down markets. But most of the time, over the long-term your income naturally goes up more than inflation with the CHIM, but the risk is that it can also go down. You'll also get about the same amount of income yield with the CHIM even if the market values of the mutual funds go down. Yields sometimes even go up when the markets go down. But even if it did go down, and stayed down for years, when it goes back up then it won't take very long to outgrow the annuity, when that is only accumulating interest at 1.05%. Then think about the fact that you are not locked into anything with any DIY investment model. If you have an emergency and need money, you can just sell shares and deal with it. Then you can control which ones are sold, and how they're taxed, or not. Also, you may even be able to sell what's currently down at a loss, creating a tax credit (the opposite of paying a tax). With a fixed annuity, you can't do anything (once it's annuitized). Sometimes you can sell before annuitization, but only about 10% of the account balance a year. If you sell before it's annuitized, then you'll probably also have high surrender charges - which are as follows. This is the amount of money the insurance company just keeps if you sell out "early." Then there's taxes, and maybe even a 10% penalty tax to pay too. Here's this New York Life's annuity's surrender charge schedule: Year #1: 7% At time of this writing (2011), the CHIM yields 5.0% and the best NY Life fixed annuity yielded 4.1% (assuming you dealt with all of the risks that are certain to happen with riders, which the CHIM covers all by default for free anyway). This difference in yield is 18% (4.1% vs. 5%). Then when you look at it from the point of view that you should have had $400,000 when you annuitized (and not just $113,457), you're comparing whatever the CHIM is yielding to a fixed annuity yield of ~1.1% (not even the 4.1% used in the previous example). The chances of the CHIM's annual total return averaging less than 2% for an extended period of time (more than ten years) is slim to none, and Slim left town. If it did, then things would be so bad that even cash under the mattress would be virtually worthless. This is because most everyone would be dead. If things really did get that bad, then most all life insurance companies would be belly up, they won't be paying at all; and so your annuity would be even more worthless than the CHIM, because you could still sell CHIM shares for pennies on the dollar. So the bottom line choice to make is this: Do you want to give up control, and 18% (really 78% - the difference between 5% and 1.1%) of your retirement paycheck, just to get the "safe life-long guarantee" from a life insurance company? When you think safety, also think, I'm totally 100% stuck with this contract for life too. If you chose the annuity, then you're just a sheeple, because you can do better most of the time with just bank FDIC insured CDs (when considering all of the Different types of risks). Also keep in mind that life insurance companies do go under! If it wasn't for $182 BILLION of your bailout tax dollars, the biggest life insurance company in the world (AIG) would have went belly-up and defaulted on everything, including their fixed annuities, in 2009. So don't fall for their guarantees - if "the world breaks enough" that you think these guarantees will save you, then most all of them will be going under as well. Then money in the bank (under the FDIC limit), and hidden under the mattress, will end up being the only places where you'll still have some left to survive on. So as you can see, there are NO guarantees whatsoever in life - regardless of who tells you what. All life insurance companies are just as risky as everything else in the financial services industry, when you account for everything properly. Then as all of the above math proved, even it things work out as planned, you'll still do better with bank CDs or our CHIM. This is because both of these methods automatically solve both risks that are 100% guaranteed to happen - which are inflation, and the life insurance company keeping your money when you die. Then there's fiasco if being "stuck" too. Our free Money eBook is a great place to get the Real World education needed to get a better grip on reality. So no matter how you look at it, if you use cold hard logic combined with facts, contracts, and math, then there's little to no reason to buy fixed annuities (then variable annuities are much worse). Here's how these annuities work in a nutshell: All fixed annuities are like giving a third of your money away to the life insurance company, and realizing little-to-nothing in return for it. Where does that money go? For example, using $100, $65 went into the life insurance company's general fixed account, which is what's "safe." That money went into a savings account and is used to pay your payments. $35 went into the life insurance company's profit margin. This "rainy day fund" is needed to ensure the life insurance company will survive if and when the government causes massive debacles that wipe out everything financial, again (AKA a Meltdown). With fixed index annuities, most of this $35 is spent on constantly buying call options on the stock market. So when the market goes up, then they execute the calls, and profit. Then they share some, but definitely not all, of these profits with the policyholder. If the market does not go up (enough), then these options expire, meaning the money spent on them just permanently vanishes (just like a race track gambling bet). This all seems fine, until you get the big picture. The life insurance really needs this $35 put into its rainy day fund to ensure its survival. It didn't do that with FIAs. So when things are fine, everyone wins. But when the government gets around to breaking the world again, not an if but a when, then it may be so bad that this time failed life insurance companies will not get bailed out with gazillions of your tax dollars. So they'll go under, and EVERYTHING they promised to pay you will evaporate forever. That's the problem with FIAs. It significantly raises the systemic risks of the life insurance industry. With all Wall Street shenanigans, everything is fine, until it's not. Then when everything crashes, EVERYTHING crashes together. So that's the risk. It may be that if AIG writes too many FIAs, that alone may be the straw that broke that camel's back. Then without a new multi-gazillion tax dollar bailout, you can kiss everything to do with AIG goodbye forever this time. So as you can see, life insurance companies are not nearly as safe as everything thinks. Just the opposite, the hunger for profits just sets everyone up for repeating massive failures, again and as usual. So if you want your cake and be able to eat it to, then just use our CHIM; and if that's too boring for you, then set a third of your money aside and buy call options yourself. Or buy the CHIM and/or a fixed annuity with 75% of your money, and then buy an S&P 500 ETF or index fund with the other 25%. The lesson here is the same with the banks: If being in the boring mundane life insurance industry is not profitable enough for you, then get out and run money like everyone else! Do not use the public's most trusted source of mega money to bank roll your adventures just so you can get your multi-gazillion dollar bonuses. Banks should make loans (like they used to - not just mortgages, auto loans, and credit cards @ usury 36% APR), manage checking and savings account, and sell CDs, and that's all. The commission-based Merrill stockbroker sitting in most Bank of America branches next to the loan officer needs to go to way of the dinosaurs ASAP too. Life insurance companies should sell life insurance and annuities, and that's all, period, full stop. Anything more than that are just shenanigans, and needs to be spun off ASAP. Why doesn't the government "do something" about this, before it's too late? There's massive amounts of pressure, brain cells, and money telling them they need to deregulate Wall Street, and little-to-no public outcry about the dangers. So they just give in to the hands that feed them the best, and do nothing. It's just as simple as that. Why You Shouldn't Fear Bond Mutual Funds when Interest Rates are Low Another reason why investors buy fixed annuities, is because they think they're going to lose a lot of principal forever if they buy bonds when interest rates are low (and are about to go up). • Bond mutual funds hold hundreds of bonds of all different sectors and maturities. So a rate increase in one sector won't be as much of a hit in the others. • When you invest in mutual funds "correctly," then you'll own a few types of bond mutual funds of different sectors, maturities, and countries. So a rate increase in one sector, or country, won't be as much of a hit in the others. • When bonds mature, or are called, these proceeds are used to buy new bonds with the current higher interest rates. This raises the average yield of the fund. • If there's a net outflow of money because of redemptions (from scared sheeple buying high and then selling low), then the bond mutual fund will sell bonds at a capital loss to drum up this money. This effectively eradicates these lower-yielding bonds from the portfolio. So just don't be in the herd of scared sheeple doing that, and it won't matter too much this time next year. If it's a good bond fund, then this is the best time to buy more shares on sale (which will increase your retirement paycheck later). • There's usually net inflows of new money always flowing into good bond mutual funds (just from economic growth and new investors entering the markets), and this money is used to buy new bonds with the higher interest rates. • The constant automatic reinvestment of bond coupon interest is used to buy new bonds with the higher interest rates. • When the bond fund's yields start to go back up to par with market rates (because new higher-yielding bonds are always being purchased), then this attracts money that was sitting on the sidelines waiting before, because they were afraid of interest rates going up. So when it's "safe to buy again," a flood of new money comes in (to get the higher yields), which enables the fund to buy even more new bonds at the currently higher interest rates. This creates a vicious cycle which creates a self-fulfilling prophesy. So the combined effects of the five above points all lead to both dampening the initial NAV (the mutual funds' net asset value) decline, NAV slowly increasing over time (usually back to its original level), and making it so your yield steadily increases back up to prevailing market interest rates over time. All of these forces increases your retirement paycheck over time. So all you need to do is nothing. So just wait it out. • Bond mutual funds sometimes use derivatives to hedge their portfolios to not be hurt when this happens (PIMCO did this too much, which is why it was banned from our mutual fund selections back when Gross was managing. But until the numbers improve, it's still banned because of these shenanigans). • Low yields are a sign of a bad economy. If you're in a bad economy in the 21st century, and interest rates go up, it's because the economy is getting better (not because inflation is rearing its ugly head again, which was the main concern in most of the last century). What's going to happen then is credit quality will improve, creating a damper on price decreases. This is because existing bonds in the marketplace will have their prices bid up, because they're now "safer," because the issuing firms are making more net profits, thus lowering the chances of defaulting. The whole paradigm where everyone fears interest rates going up wildly, because inflation is going up wildly and will become out of control; was very much only a 20th century problem. It will be decades before that problem ever comes back. The problem of the 21st century is so little inflation that the risk is actual deflation. There won't be annual inflation over 5% for many many years. The Federal Reserve "jacking up interest rates" to very high levels to squash an inflationary spiral only happens when inflation is above 6%, and is expected to keep rising. This scenario is probably not going to happen ever again. • Bond funds also like to hold bonds to maturity, which makes this all moot. All of this (fearing bond price declines because of interest rate increases) only matters if the mutual fund plans to sell bonds before maturity. They usually don't, for five reasons: 1) They don't have to because they have a perpetual time horizon (there's no events coming up to create a need to sell anything). 2) They don't want to take the loss. 3) There's usually a steady stream of new money coming in, which means they usually need to buy much more than sell. 4) There's usually enough cash on hand to easily meet net redemptions. 5) They usually only sell bonds before maturity when there's a nice capital gain profit to be plucked. So when there's no easy profit, they just hold until maturity, thus eliminating all potential losses. So they just don't sell before maturity most of the time. So most of the effects of bond mutual funds going down when interest rates go up are much less than an individual investor holding individual bonds. Then the mutual fund's NAV declines only last a year or so. Then they tend to return to previous levels (whereas the price decline in an individual bond is locked in, and doesn't go away until maturity). So just don't buy individual bonds - that's an "80's way of investing" back before basic online discount brokerage technology. So if you are not planning to sell shares within a year, then all that's going to happen is that you'll start to see your average yield slowly increase. This is exactly what you want - more retirement paycheck over time. When the NAV (share price) does go down, this is just a temporary opportunity to buy more shares on sale. So do that instead. When interest rates are low, and you buy fixed annuities, then you're guaranteed to be getting a very bad deal. This is because you're permanently locking in a temporarily very low interest rate (the same thing that would happen if you were to buy a long-term bond). The fixed annuity yield may go up a little when interest rates go up, but not much. This is usually because your slice of the general account your tranche was invested in is permanently linked to the long-term low-interest bearing bonds that were actually bought. In English, the life insurance company just goes out into the marketplace and buys a bunch of long-term bonds, say at an average of 7%. Your money is what funds this purchase. Then you get 5% and they keep 2%, as part of their profit-generating machine. This small slice (tranche) of the much larger pie (general account) is usually stuck married together for life (at least 20 years, because they're usually buying 20-year+ maturity bonds). So even if prevailing interest rates go up, it doesn't matter to you because the investments in your tranche didn't change. The only thing that changed is that the price of the underlying bonds went down, given the insurance company even more reason to not increase your yield. So even if the yield on the rest of the general account now goes up to 8%, your slice of it remains stuck only getting 7%. So this is why you may not see an increase of more than 5.5% if you lock in a fixed rate of 5%. All of this is another meaning of the word "fixed" when it comes to fixed annuities. Your yield is guaranteed to not go below 5%, but one of the many very high prices you'll pay for that, is that it will rarely yield much more than 5% too. So your 5% may seem great when the economy is broken, you're stuck frozen like a deer in headlights and are afraid to invest in America, but guess what? This is America - we will eventually bounce back one way or another. So when things become less broken, you're not going to be a happy camper when the same annuity rate is 7%, bank CDs are paying over 6%, bond mutual funds are paying 8%, and the stock markets are back to going up 9% a year. People know to buy investments low when everything is on sale; and sheeple... well they just follow whomever is leading them into the slaughterhouse at the moment. So if all of this is a reason why you were considering fixed annuities instead of bond mutual funds, then just don't do that, and you'll be much better off. The way to solve most all of these retirement income problems is to just use our Conservative High-income Model Portfolio. Here's the shortest bottom line on all forms of annuities (and all forms of whole life insurance): If you work in the life insurance business, either as an agent or an employee of a life company, or hold life insurance company stock; then annuities and whole life insurance are the greatest invention since the wheel. This is because they pay by far the most in immediate commissions of any financial product available today. Then their contracts allow several types of fees to fleece their sheeple little-by-little every day. All of this adds up to making them by far the most profitable part of the life insurance company business model. But if you're an investor, then these brilliant Wall Street "financial innovations" are nowhere close to being the good deal as they're advertised to be. Just "do the math" and you'll see in a New York minute.

Warning for annuity salespeople Why you should avoid variable annuities (VA) About the life insurance company business model Why complain about the life insurance industry so much? Read the short version of estate planning and estate planning software Analysis of and comparison between buying term vs. whole life insurance |

Financial Planning Software Modules For Sale (are listed below) Financial Planning Software that's Fully-Integrated Goals-Only "Financial Planning Software" Retirement Planning Software Menu: Something for Everyone Comprehensive Asset Allocation Software Model Portfolio Allocations with Historical Returns Monthly-updated ETF and Mutual Fund Picks DIY Investment Portfolio Benchmarking Program Financial Planning Fact Finders for Financial Planners Gathering Data from Clients Investment Policy Statement Software (IPS) Life Insurance Calculator (AKA Capital Needs Analysis Software) Bond Calculators for Duration, Convexity, YTM, Accretion, and Amortization Investment Software for Comparing the 27 Most Popular Methods of Investing Rental Real Estate Investing Software Net Worth Calculator (Balance Sheet Maker) and 75-year Net Worth Projector Financial Seminar Covering Retirement Planning and Investment Management Sales Tools for Financial Adviser Marketing Personal Budget Software and 75-year Cash Flow Projector TVM Financial Tools and Financial Calculators Our Unique Financial Services Buy or Sell a Financial Planning Practice Miscellaneous Pages of Interest Primer Tutorial to Learn the Basics of Financial Planning Software About the Department of Labor's New Fiduciary Rules Using Asset Allocation to Manage Money Download Brokerage Data into Spreadsheets How to Integrate Financial Planning Software Modules to Share Data CRM and Portfolio Management Software About Efficient Frontier Portfolio Optimizers Calculating Your Investment Risk Tolerance |

© Copyright 1997 - 2018 Tools For Money, All Rights Reserved